Accounting jobs come in a variety of shapes and sizes, each with its own set of responsibilities, levels of seniority, and expectations. Accounting jobs all have one thing in common: They all involve evaluating and interpreting a person’s or an organization’s financial actions. The primary responsibilities for each role differ substantially. However, they all revolve upon understanding and analyzing financial data.

Employment in this profession is projected to diminish as corporations increase their use of technology. The Bureau of Labor Statistics (BLS) estimates the demand for accounting professionals or accounts payable specialists to decrease by 8% between 2018 and 2028. The report also includes the average yearly income for an accounting clerk in 2018, which was $40,240.

To be successful as an accounts payable specialist, you should have a strong understanding of the accounting best practices along with hands-on experience in a similar position. To have a comprehensive view of the position and how to write an accounts payable resume, read on for the full article and start your career.

What is an Accounts Payable Specialist?

Accounts payable professionals are responsible for ensuring that vendors are paid for the services and products they provide. They audit credit card bills, respond to vendor questions, reconcile vendor statements, prepare and preserve 1099 statements, and process and distribute checks.

An ideal accounts payable specialist will have at least two years of experience in the field and a high school educational attainment. In addition, accounting courses in college are preferred. With regard to the job description for an accounts payable specialist, emphasize the importance of organization and time management abilities, as well as the ability to multitask.

A high school diploma or GED certificate is required for accounts payable specialists. Some employers prefer applicants who have completed some form of post-secondary education. Many of the candidates do not have a bachelor’s degree. Basic financial accounting, business algebra, accounting technology, and written business communication are all relevant courses.

Although a bachelor’s degree is usually never required for this career, graduates with this level of education may be able to get a foot in the door by applying for an entry-level position, such as an accounts payable specialist.

What are the Duties of an Accounts Payable Specialist?

Accounts payable specialist responsibilities vary depending on the size and industry of the organization for which they work, but they often include:

- Maintaining petty cash accounts and keeping track of all incoming and outgoing disbursements

- Monitoring of vendor payment arrangements for discounts to minimize invoice amounts

- Payment of sales tax on invoices and keeping track of each tax payment

- Keeping track of the company’s outstanding debts

- Credits are applied to vendor payments as needed

- Monthly reconciliation of payable reports to ensure the correct amount of all monetary payments

Now, you have an idea of what to include on your accounts payable resume. Aside from the job duties, here are a few things to bear in mind:

- Education: A high school graduation is required, with an associate’s degree recommended.

- Areas of expertise: basic math skills, computer skills, spreadsheet and bookkeeping software familiarity are all required.

- All accounting, bookkeeping, and auditing clerks will see a 4% job growth from 2018 to 2028.

- For all accounting, bookkeeping, and auditing clerks, the median salary in 2018 was $40,240.

How Do You Become an Accounts Payable Specialist?

To work as an accounts payable specialist, you’ll usually need some college education. Accounting coursework is preferred by many companies; alternative areas of study could include taxation, corporate ethics, and economics. Some programs involve fieldwork or a capstone project that allows students to apply what they’ve learned in the classroom to a real-world situation.

🔍 Think Your Resume’s Fine? Let’s Double-Check That

Even strong resumes can miss critical details—especially when it comes to passing Applicant Tracking Systems (ATS). Our specialists offer a free review to uncover gaps, improve formatting, and ensure your resume is ATS-ready and recruiter-friendly.

Is it necessary to be certified? While certification isn’t necessary for accounts payable professionals, it can help you advance your career by demonstrating your ability to handle a wide range of accounting responsibilities. Accounts payable professionals can get certification by passing examinations such as the National Bookkeeper Association’s Uniform Bookkeeper Certification Examination or the American Institute of Professional Bookkeepers’ exam. They can utilize the Certified Bookkeeper (CB) designation after passing the exam.

What to Include on Your Accounts Payable Resume

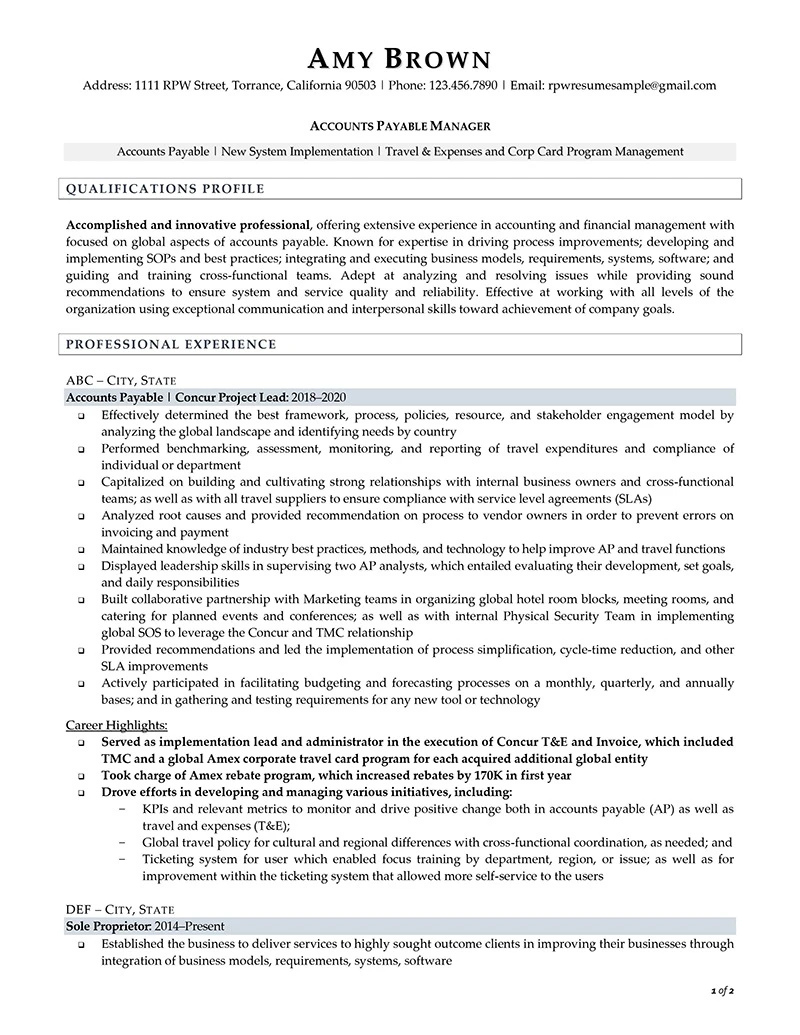

As an accounts payable specialist, you have to make sure that all company data must be accounted for. If you are interested in this career, you may use our accounts payable resume example to learn how to write a resume that will make hiring managers take your qualifications into account and trust your credibility. Read on to know the details needed to include on your resume.

Contact Information

Starting right at the top of your accounts payable resume, write your first and last name, complete mailing address, phone number, and email address. You may also put your LinkedIn profile URL and website, if there are any. Plus, placing your certification beside your name can increase the chances of your resume getting noticed.

Specific Target Job

Also known as ‘career tag’, your desired job position allows hiring managers and recruiters know what job position you’re aiming for.

Qualifications Profile / Summary of Qualifications

Crafting a striking resume summary is a must in order to boost your hiring chances. Take note that hiring managers spend an average of six seconds to review an applicant’s resume. Hence, it’s important that you highlight what you can contribute to their organization as an accounts payable specialist straightaway.

Expert Tip:

When writing your summary, steer away from the resume objective-type statement. Instead, use compelling titles and headlines to catch the hiring manager’s attention.

Accounts Payable Specialist Skills

Since accounts payable specialists offer years of experience in the field, it is already a given that they have a lot of industry-specific and soft skills to showcase. That said; it’s crucial that you sort out and choose what skills you should put on your accounts payable specialist resume.

Ways to List and Create Headings for Job Skills in a Resume

Work Experience

When listing your work experience, start with your most recent job down to your first job. Include the company names and their locations, your job titles, and the employment dates. As for your job descriptions, notable contributions, and accomplishments, it’s highly recommended to describe them using bullet points. This way, hiring managers can easily review your work history without missing important details.

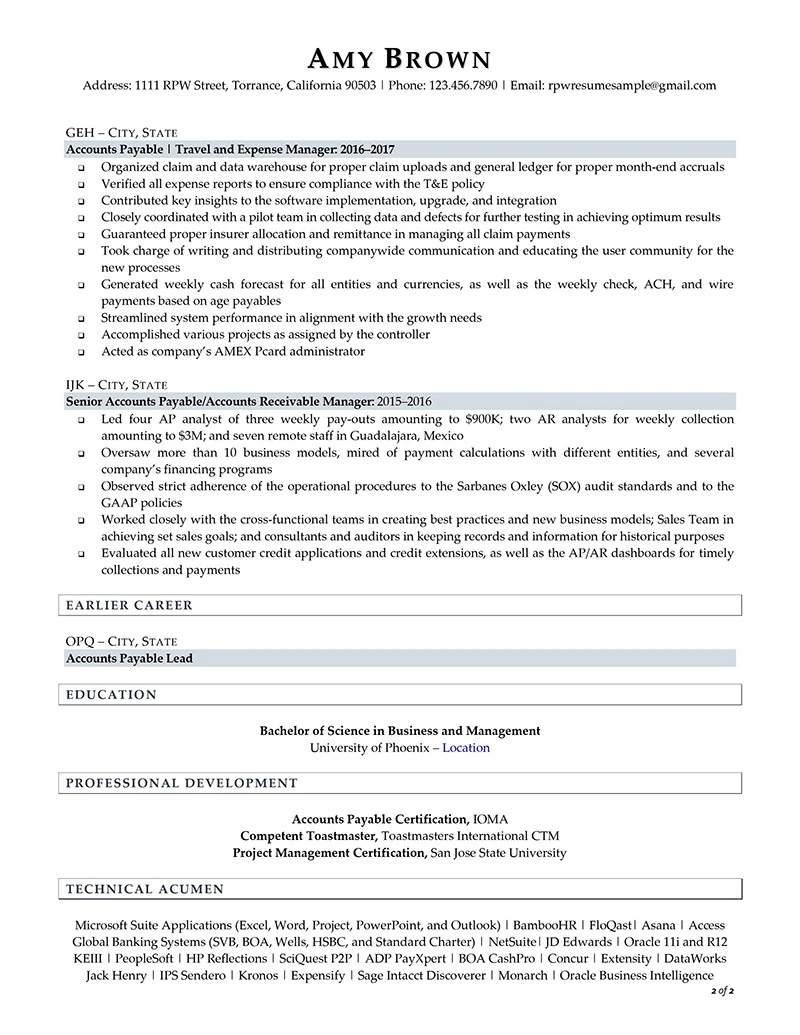

Education

Take note that academic background is one of the factors that hiring managers consider in the hiring and recruitment process. Thus, in order to catch their attention, make sure your education section is well-written. Include your complete degree and course title, school name and its location, and the dates of your graduation. Plus, mentioning your awards, honors, recognition, and scholarships you received can help you take one step ahead of the competition.

Training, Certifications, and Licenses

In order to get qualified for the position, you’ll need a high school diploma along with months taken under on-the-job-training. According to the BLS, accounts payable specialists acquire the highest level of employment in this career across the states of California, Florida, New York, Ohio, and Texas. Hence, grab this opportunity to impress hiring managers that you have maintained active involvement in different training, workshops, and seminars as well as obtained industry-related certifications and licenses.

Other Possible Information to Include on Your Accounts Payable Resume

To spice up your accounts payable resume, you might want to include your professional affiliations, activities, technical skills, and projects handled.

How to Write Your Accounts Payable Resume

Now that you have an idea on what to include on your accounts payable resume, knowing how to write them on your job search tool should be your next step. To help you, we’ve listed some tips in crafting an effective accounts payable resume.

1. Apply simple yet attractive design and layout.

Decorating your accounts payable resume with designs and fancy font styles might kill the chances of getting your resume to the pile of accepted applications. A simple yet engaging design and layout as well as easy-to-read resume will do to land a job interview.

2. Choose the best resume format.

When writing your accounts payable resume, use the best resume format that will speak of your qualifications, skills, and experience. If you already have extensive experience in the field, the chronological resume format should be your top pick. On the other hand, you may use other resume formats to showcase what you can contribute to their organization.

3. Highlight your accounts payable skills.

Since you’re applying for an accounts payable specialist position, you must highlight the skills relevant to the job. Be sure to demonstrate attention to detail and timeliness in managing disbursement functions.

4. Include resume keywords.

With resume keywords, employers can easily identify and evaluate whether you are the perfect fit for the position or not. That said; it’s pertinent that you put these terms not only under the skills section but also throughout your accounts payable resume. Furthermore, including these resume keywords can help you pass the applicant tracking systems.

Expert Tip:

Resume keywords are job-related or industry-specific words and phrases outlined in job postings. Hence, make sure that your job search tool matches the job ad.

5. Use concrete data and examples.

Presenting figures and examples when describing your job descriptions and accomplishments is much better than listing plain information. These details will help you stand out among other job candidates.

6. Proofread, proofread, and proofread.

Before submitting your accounts payable resume, read it over and over again. Doing so will help you check, spot, and correct errors, such as grammar and punctuation mistakes. Plus, keeping your resume free from error can increase your chances of securing job interviews.

Accounts Payable Specialist Resume Example

To give you an idea on how an effective accounts payable resume looks like, below is an example written by one of our professional accounting resume writers:

Accounts Payable Resume Example Page One

Accounts Payable Resume Example Page Two

Note: You may check out our different accounting resume examples for more ideas.

Let Our Accounting Resume Writers Help You Ace Your Job Search

If you’re looking for the best accounting resume writing services, you can always count on Resume Professional Writers. We have expert writers who are knowledgeable not only of the accounting industry but also resume writing standards. Contact us today to get started.