Many finance and accounting professionals strive to advance their careers but often face the challenge of balancing technical expertise with leadership responsibility. To stand out as an accounting manager, it takes more than number-crunching—employers look for strategic thinkers with regulatory know-how and the ability to guide diverse teams toward organizational success.

This guide breaks down the modern accounting manager job description: key responsibilities, essential skills, salary outlook, and industry demand. It also highlights the educational pathways and certifications that boost credibility in 2026’s competitive financial landscape.

Overview of the Accounting Manager Role

The accounting manager serves as the pivotal link between executive leadership and the accounting team, overseeing financial reporting, internal controls, and budgetary processes. This role ensures financial data accuracy, compliance with Generally Accepted Accounting Principles (GAAP), and timely reporting to support decision-making across departments.

Accounting managers are typically employed in:

- Corporate entities

- Nonprofit organizations

- Healthcare systems

- Government agencies

- Financial institutions

Most accounting managers report directly to a controller, finance director, or chief financial officer (CFO). They lead teams composed of accountants, analysts, and bookkeepers, ensuring consistent performance and adherence to corporate standards. Because they often manage multi-million-dollar budgets, integrity, precision, and leadership discipline remain core expectations for the accounting manager job description.

The Bureau of Labor Statistics (BLS) reports steady growth in management-level accounting positions driven by regulatory changes, business expansion, and technological integrations in corporate finance systems. A modern accounting manager job description should reflect this demand. Employers value professionals capable of translating numerical insights into strategic recommendations that influence profitability and reduce risk exposure. As automation reshapes transaction-level processes, accounting manager description increasingly emphasizes on analytics, forecasting, and financial governance.

Accounting Manager Job Description and Key Responsibilities

Accounting managers oversee critical financial operations that sustain transparency, compliance, and efficiency. The scope of responsibilities varies depending on company size, but certain foundational duties remain consistent across industries.

Financial Reporting and Analysis

Accounting managers prepare monthly, quarterly, and annual financial statements in accordance with GAAP and company policy, ensuring data integrity for stakeholders.

Budget Management

They coordinate the annual budgeting process, monitor variances, and guide leadership on resource allocation to optimize fiscal performance.

Internal Controls and Compliance

These professionals establish and maintain internal audit systems to prevent fraud, enforce accuracy, and ensure compliance with federal and state regulations.

Process Improvement

Accounting managers analyze existing workflows, implement automation tools, and refine processes to increase reporting speed and consistency.

Team Leadership

Supervising accountants and finance staff, they deliver training, performance reviews, and mentorship aligned with organizational priorities.

Cross-Department Collaboration

They work closely with operations, HR, and procurement leaders to align financial practices with overall company strategy.

Regulatory Filings

They ensure timely completion of tax obligations and compliance reports, often collaborating with external auditors and regulatory agencies.

Strong analytical thinking, adaptability, and proficiency in enterprise resource planning (ERP) systems distinguish top performers in this role. Many organizations now expect accounting managers to participate in digital transformation projects, integrating artificial intelligence (AI) tools for data analysis or predictive modeling.

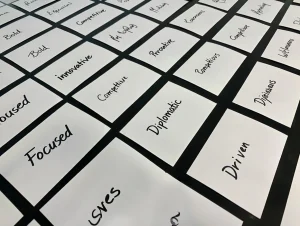

Essential Skills and Competencies

To excel in the accounting manager job description, professionals must balance technical, analytical, and interpersonal skills. Competency across these areas ensures smooth department operations and accurate reporting. In addition to accounting expertise, exceptional communication and leadership abilities define success in this management tier.

Technical Proficiency

Mastery of accounting software such as QuickBooks, Oracle NetSuite, SAP, or Microsoft Dynamics is essential, along with familiarity with cloud-based accounting solutions.

Regulatory Knowledge

Accounting managers must stay informed about evolving GAAP standards, Sarbanes–Oxley (SOX) compliance, and Internal Revenue Service (IRS) guidelines impacting financial reporting.

Analytical Capability

They interpret complex data sets to identify trends, risks, and improvement opportunities that affect business growth.

Leadership and Delegation

Strong management ensures department efficiency, morale, and consistent delivery against corporate performance metrics.

Communication and Presentation

Accounting managers frequently present reports to senior executives, requiring the ability to explain complex financial concepts in accessible, strategic terms.

Problem-Solving and Critical Thinking

Identifying discrepancies or inefficiencies in accounting systems demands confident judgment, strategic thinking, and data-driven decision-making.

Modern employers also seek digital fluency, particularly in advanced Excel analytics, business intelligence platforms, and predictive modeling tools. These technical skills enable managers to produce actionable financial insights beyond traditional bookkeeping functions.

Educational Requirements and Certifications

Most accounting managers hold at least a bachelor’s degree in accounting, finance, or business administration from an accredited institution. A master’s degree in business administration (MBA) or accounting often provides a competitive advantage, particularly in large organizations and public accounting firms.

Certified Public Accountant (CPA)

Widely regarded as the gold standard for accounting professionals in the United States, this certification demonstrates mastery of advanced accounting principles and compliance ethics.

Certified Management Accountant (CMA)

Awarded by the Institute of Management Accountants (IMA), this credential validates expertise in managerial accounting and decision support.

Certified Internal Auditor (CIA)

Offered by the Institute of Internal Auditors, this designation reflects deep proficiency in internal control assessments and organizational risk management.

Chartered Financial Analyst (CFA)

Although more investment-focused, this credential benefits accounting managers engaged in financial planning and analysis roles.

Employers often prefer CPA-certified professionals for leadership positions due to their demonstrated understanding of audit performance and regulatory standards. When combined with years of general accounting experience, these credentials strengthen credibility and earning potential considerably.

Work Environment and Industry Opportunities

The accounting manager job description often places professionals in structured environments characterized by strict data integrity standards and tight reporting deadlines. Finance departments in private corporations, public enterprises, and government agencies share an emphasis on compliance and organizational accountability. While many employers maintain traditional office-based roles, hybrid and remote accounting management positions have increased significantly, particularly across technology and healthcare sectors.

Industries with the highest demand for roles outlined in an accounting manager job description include:

- Financial Services

- Manufacturing

- Healthcare Administration

- Information Technology

In these environments, accounting managers balance daily operations oversight with strategic forecasting. Within corporate finance divisions, they often partner with business intelligence teams to identify revenue trends, optimize departmental budgets, and streamline compliance audits.

Salary Outlook and Job Market Trends

The median annual wage for accounting managers in the United States currently ranges between $100,000 and $125,000, depending on organization size, region, and experience level (according to PayScale and the U.S. Bureau of Labor Statistics). Senior accounting managers or those holding CPA and MBA credentials often earn well above $140,000 annually, particularly in metropolitan areas such as New York, San Francisco, and Chicago.

| Experience Level | Average Salary Range |

|---|---|

| Entry-Level (up to 5 years) | $75,000–$95,000 |

| Mid-Level (5–10 years) | $95,000–$120,000 |

| Senior Accounting Manager | $120,000–$160,000+ |

Accounting professionals with advanced technical acumen—particularly in data analytics, automation, and compliance—experience faster promotions and higher compensation. With consistent demand for accountability and fiscal transparency, the occupation remains resilient against economic fluctuations.

As digital transformation reshapes accounting workflows, a competitive accounting manager job description in 2026 highlights the need for advanced education, certifications, leadership skills, data visualization skills, and proficiency in automated financial reporting tools. Professionals who embrace innovation in AI or robotic process automation (RPA) systems command higher salaries than traditional peers who focus solely on transactional tasks.

Career Path and Growth Opportunities

Career progression for an accounting manager generally follows a structured path, beginning with roles such as staff accountant, senior accountant, and then promotion into a supervisory position. From there, leadership advancement may lead to positions such as controller, finance director, or chief financial officer (CFO). Those specializing in niche areas—like corporate tax, mergers and acquisitions, or international accounting—can transition into consulting or executive leadership.

Controller

Oversees all accounting operations and financial reporting for the organization.

Finance Director

Aligns accounting policies with broader business strategies and forecasts.

Chief Financial Officer (CFO)

Leads financial planning, investor relations, and organizational strategy.

Consultant or Auditor

Provides external financial advice or compliance evaluations across industries.

Continuous professional development through online courses, certifications, and leadership programs strengthens promotional prospects. Organizations are now increasingly focusing on leadership diversity, digital innovation, and sustainability—giving accounting managers opportunities to influence corporate ethics, ESG reporting, and financial modernization.

How to Craft a Competitive Accounting Manager Resume

An effective resume for an accounting manager highlights technical expertise, quantifiable results, and leadership outcomes. Hiring teams prioritize metrics such as cost reduction, audit accuracy, and process efficiency. Strategic resume optimization and alignment with job-specific keywords also significantly improve visibility within applicant tracking systems (ATS).

- Emphasize Achievements: Showcase quantifiable results such as closing books five days early, reducing reporting discrepancies, or leading ERP integration that enhanced data accuracy.

- Incorporate Key Skills: Include financial forecasting, team leadership, audit control, and compliance enforcement as primary keyword phrases.

- Tailor Content: Reflect industry-specific metrics, whether manufacturing variance analysis or healthcare reimbursement compliance.

- Use Modern Formatting: Apply clear section headings, consistent tense, and ATS-readable design for maximum pass-through rates.

- Highlight Certifications: Listing CPA, CMA, or other credentials signals professional mastery and dedication to continuous growth.

Job seekers can enhance employer engagement and shorten job searches by coupling strong résumés with tailored leadership summaries. Measurable results—expressed through percentages, cost savings, and process improvements—position candidates as strategic contributors rather than merely technical supervisors.

The Evolving Outlook for Accounting Manager Job Description

Technology-driven transformation and AI are reshaping accounting management, automating routine tasks through artificial intelligence and machine learning tools. This shift allows accounting managers to focus on interpreting data, risk management, and strategic planning.

As digital infrastructures grow, expertise in data governance, ESG reporting, and global compliance is now more valuable than ever. Employers now prioritize those professionals who demonstrate modern accounting manager job description, which includes thriving in hybrid roles and the ability to combine business insight with technical fluency, adaptability, and continuous learning.

With ongoing economic diversification and increased emphasis on accountability, accounting managers remain integral to both private enterprise and public governance. Their blend of analytical insight and ethical stewardship positions them as critical assets in shaping financial sustainability and corporate reputation.

Empower Your Accounting Leadership Career for Long-Term Success

Accounting managers occupy one of the most pivotal roles in safeguarding organizational integrity and growth potential. They thrive when technical mastery meets strategic vision—but standing out requires more than expertise. Those seeking to elevate their professional presentation can strengthen their market value through professional resume writing help that aligns credentials and achievements with modern employer expectations in finance and accounting leadership.

Take the next step—position yourself as the accounting leader every organization needs.

Frequently Asked Questions

What are the main responsibilities of an accounting manager?

An accounting manager oversees financial reporting, budget management, and internal controls. The role includes team supervision, compliance monitoring, and financial data verification to ensure corporate integrity and accurate reporting for decision-making across departments.

How much do accounting managers earn in 2025?

According to the latest salary aggregates from PayScale and the U.S. Bureau of Labor Statistics, most accounting managers in 2025 earn between $100,000 and $125,000 annually, with senior-level or credentialed professionals earning over $140,000 in metropolitan markets.

What education is required to become an accounting manager?

Most organizations require a bachelor’s degree in accounting, finance, or business administration. Many employers also prefer candidates with Certified Public Accountant (CPA) credentials or an MBA for advanced leadership roles.

Is the demand for accounting managers growing?

Yes. The Bureau of Labor Statistics forecasts steady growth for accounting managers as organizations continually emphasize financial transparency, data analytics, and digital automation across financial departments nationwide.

What skills make a successful accounting manager?

Successful accounting managers possess strong analytical, leadership, and communication skills, combined with advanced technical knowledge of ERP systems, GAAP compliance, and financial forecasting. Strategic thinking and adaptability to new technologies also play vital roles.